The world is experiencing a dynamic shift in supply chains, with many businesses pivoting their strategies to secure and strengthen their networks. Amidst this transformation, Poland and the broader Central & Eastern Europe (CEE) region have emerged as preferred sourcing destinations for Scandinavian companies. In this guide, we delve into the reasons behind sourcing from Poland, the potential challenges, success factors, the range of products Nordic companies source from these regions, and actions that your company can take. secure and strengthen

There are several factors that make Poland an attractive sourcing destination:

Sourcing from Poland can be beneficial when businesses are looking for suppliers in the nearby region that deliver high-quality output, are reliable, offer good value, and are focused on building long-term relationships.

However, it may not be advantageous for businesses looking for small volumes, one-off purchases, or those with a sole focus on lowest production cost.

Successful sourcing from Poland depends on several factors:

Here at Explore Markets, we support clients in their journey into Poland, CEE, and the Nordics. Our international expansion consultants are poised to drive your growth with modern market entry strategies and local partnerships. As experts in supply chains, we offer detailed insights into the best sourcing opportunities in the CEE region. We are committed to seeing you succeed and are ready to challenge the status quo, fostering a culture of curiosity and continuous improvement.

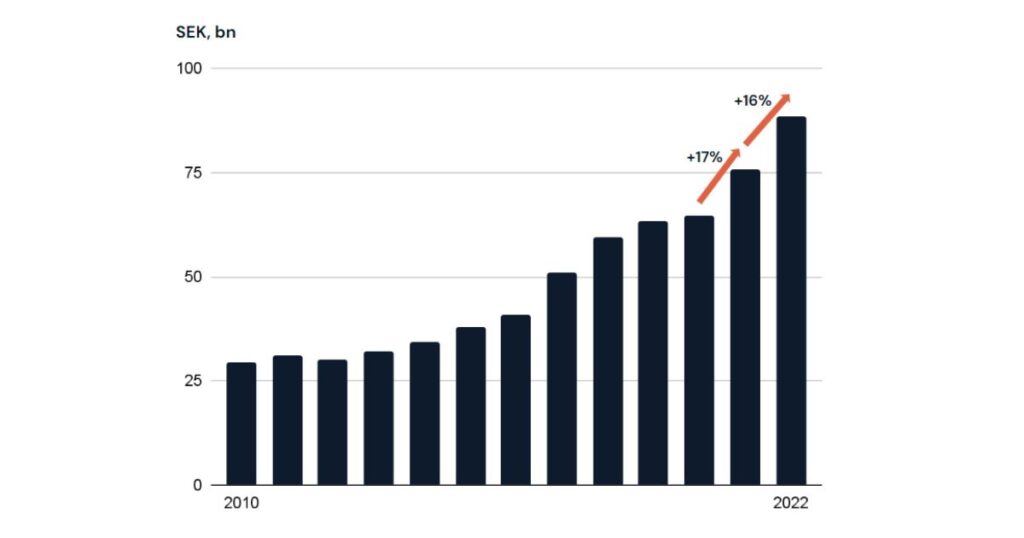

[1] Svenskt Näringsliv survey, October 2022

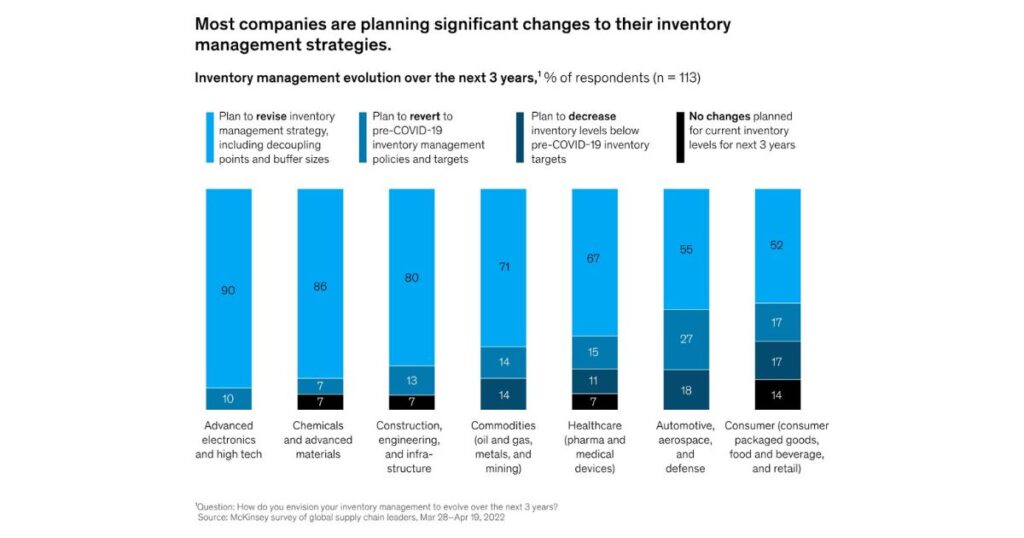

[2] “Taking the pulse of shifting supply chains”, McKinsey, August 26, 2022

[3] “Private Equity and Venture Capital in Central and Eastern Europe”, Bain, 2022

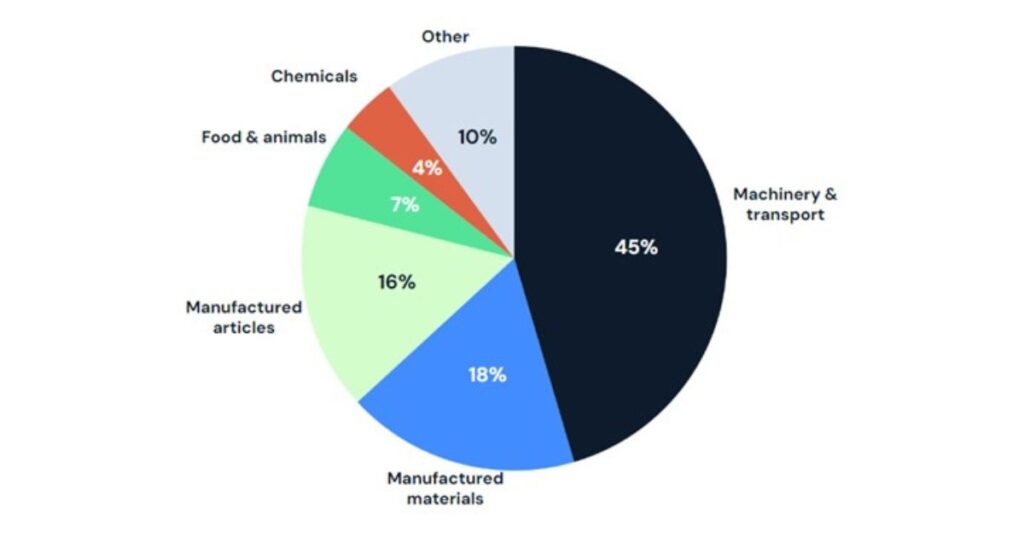

[4] “A generational shift in sourcing strategy – A global and European deep dive into near-sourcing, nearshoring and reshoring in the post-pandemic world”, Reuters Events and A.P. Moller-Maersk, November 2022

You can rely on our experienced professionals to bring their knowledge, benchmarks and best practices from variety of industries.